AMRT - Applied Microbial Technician I, (Mold Remediation)

Let's be honest, dealing with water damage in your Florida home is stressful enough without having to decode your insurance policy like it's written in ancient hieroglyphics. We get it. At Florida Fire & Flood, we've helped countless Central Florida homeowners navigate these murky waters (pun intended), and we're here to break it down for you in plain English.

The short answer? It depends. The longer answer? Well, grab a coffee and let's dive into the details that could save you thousands of dollars and a whole lot of headaches.

Understanding Florida Homeowner's Insurance Water Damage Coverage

Here's the thing about homeowner's insurance in Florida: it's complicated, and that's putting it mildly. Your standard homeowner's policy typically covers what insurance companies call "sudden and accidental" water damage. Think burst pipes, a washing machine that decides to throw a tantrum, or your water heater giving up the ghost without warning.

But here's where it gets tricky. Florida's unique geography and weather patterns mean we deal with water issues that folks in other states rarely encounter. That gorgeous lake behind your house? The afternoon thunderstorms that roll in like clockwork? These create situations that your insurance company might not cover under your basic policy.

What Water Damage Is Covered by Homeowner's Insurance?

Most standard Florida homeowner's policies will cover:

Internal Plumbing Disasters

When your pipes burst, leak, or overflow, you're usually covered. This includes damage from toilets overflowing, water heaters failing, or appliances like dishwashers and washing machines malfunctioning.

Storm Related Internal Damage

If a hurricane or severe storm damages your roof and water gets inside, that's typically covered. The key word here is "inside." We'll talk about what happens when water comes from outside in a minute.

Water Damage Exclusions: What's Usually NOT Covered

This is where things get interesting, and by interesting, we mean potentially expensive if you're not prepared.

Flood Damage from External Sources

Here's the big one that trips up a lot of Florida homeowners. If water enters your home from outside sources like rising lakes, rivers, storm surge, or even just really heavy rain that overwhelms the ground's ability to absorb it, that's considered flood damage. Standard homeowner's insurance doesn't cover floods. You need separate flood insurance for that.

Gradual Leaks and Maintenance Issues

That slow drip behind your bathroom wall that you've been meaning to fix for months? If it finally causes significant damage, your insurance company might deny the claim, arguing it was a maintenance issue you should have addressed.

Sewer and Drain Backup Water Damage

When Central Florida gets hit with those torrential afternoon storms, sewer systems can back up. This type of water damage often requires additional coverage that you have to specifically add to your policy.

Florida Specific Water Damage Insurance Challenges

Living in the Sunshine State comes with its own unique set of water related challenges that homeowners need to understand.

Hurricane Season and Water Damage Coverage

Hurricane season runs from June through November, and let's face it, we all hold our breath a little during those months. While wind damage from hurricanes is typically covered, the flooding that often comes with these storms is not. This is why flood insurance is so crucial for Florida homeowners.

Mold Coverage After Water Damage

Florida's humidity creates the perfect breeding ground for mold, especially after water damage occurs. Some insurance policies cover mold remediation, but many have strict limits on coverage amounts and timeframes for remediation. Understanding the difference between covered mold damage and excluded long-term mold issues can save you significant headaches down the road.

Older Home Plumbing and Insurance Claims

Many Central Florida homes were built decades ago with plumbing systems that weren't designed for today's water pressure and usage patterns. When these systems fail, insurance companies might scrutinize whether the damage was due to normal wear and tear versus a sudden failure.

How to Navigate Water Damage Insurance Claims Successfully

Here's where our years of experience working directly with insurance companies really comes in handy. We've seen what works and what doesn't when it comes to getting claims approved and processed quickly.

Document Everything Immediately

The moment you discover water damage, start taking photos and videos. Don't wait for the insurance adjuster to arrive. Water damage can worsen quickly, especially in Florida's humid climate, so you want to capture the initial extent of the damage. Before you start cleanup, make sure you avoid common pitfalls by reading our guide on 5 common mistakes to avoid after water damage.

Contact Your Insurance Company Right Away

Most policies require prompt notification of claims. Don't delay this step while you're trying to figure out what happened or clean up the mess yourself.

Understand Your Deductible Structure

Florida insurance policies often have different deductibles for different types of claims. You might have one deductible for regular claims and a higher percentage based deductible for hurricane claims.

Work with Experienced Water Damage Professionals

This isn't the time to wing it or try to save money with the cheapest contractor you can find. Insurance companies work with restoration professionals who understand their requirements and can document the work properly. We've built relationships with adjusters over the years, and we know how to present claims in a way that gets results. Our team holds IICRC certifications in water damage restoration, which insurance companies recognize and trust.

Additional Insurance Coverage to Consider for Florida Homes

Standard homeowner's insurance might not be enough for Florida residents. Here are some additional coverages worth considering:

Flood Insurance for Florida Homeowners

We can't stress this enough. If you live in Central Florida, you should seriously consider flood insurance. It's available through the National Flood Insurance Program and some private insurers.

Water Backup Coverage

This endorsement covers damage from sewer and drain backups, which are more common than you might think during heavy rain seasons.

Service Line Coverage

This covers the repair or replacement of underground service lines that bring water, sewer, or other utilities to your home.

Red Flags That Might Complicate Your Water Damage Claim

Some situations make insurance claims more challenging:

- Previous water damage in the same area

- Evidence of long term leaks or moisture issues

- Damage that occurs during a lapse in coverage

- Modifications to your home that weren't reported to your insurance company

- Claims filed too long after the damage occurred

Working with Professional Water Damage Restoration Companies

When water damage strikes, having a team that understands both the restoration process and insurance requirements can make all the difference. We work directly with insurance companies so you don't have to play middleman, and we know how to document everything properly to support your claim.

Our water damage restoration process starts with securing your property and assessing the full extent of the damage. We use industry standard tools and techniques that insurance companies recognize and trust.

The Bottom Line on Water Damage Insurance Coverage

Water damage insurance coverage in Florida is complex, but it doesn't have to be overwhelming. The key is understanding what your policy covers before you need it, maintaining your home properly, and working with professionals who know how to navigate the insurance landscape.

Remember, every situation is unique, and insurance policies can vary significantly. When in doubt, contact your insurance agent to clarify your coverage, and if water damage does occur, don't hesitate to reach out to experienced professionals who can guide you through the process. Being able to identify water damage early can save you thousands in insurance claims, so you might want to familiarize yourself with our guide on spotting the signs of water damage.

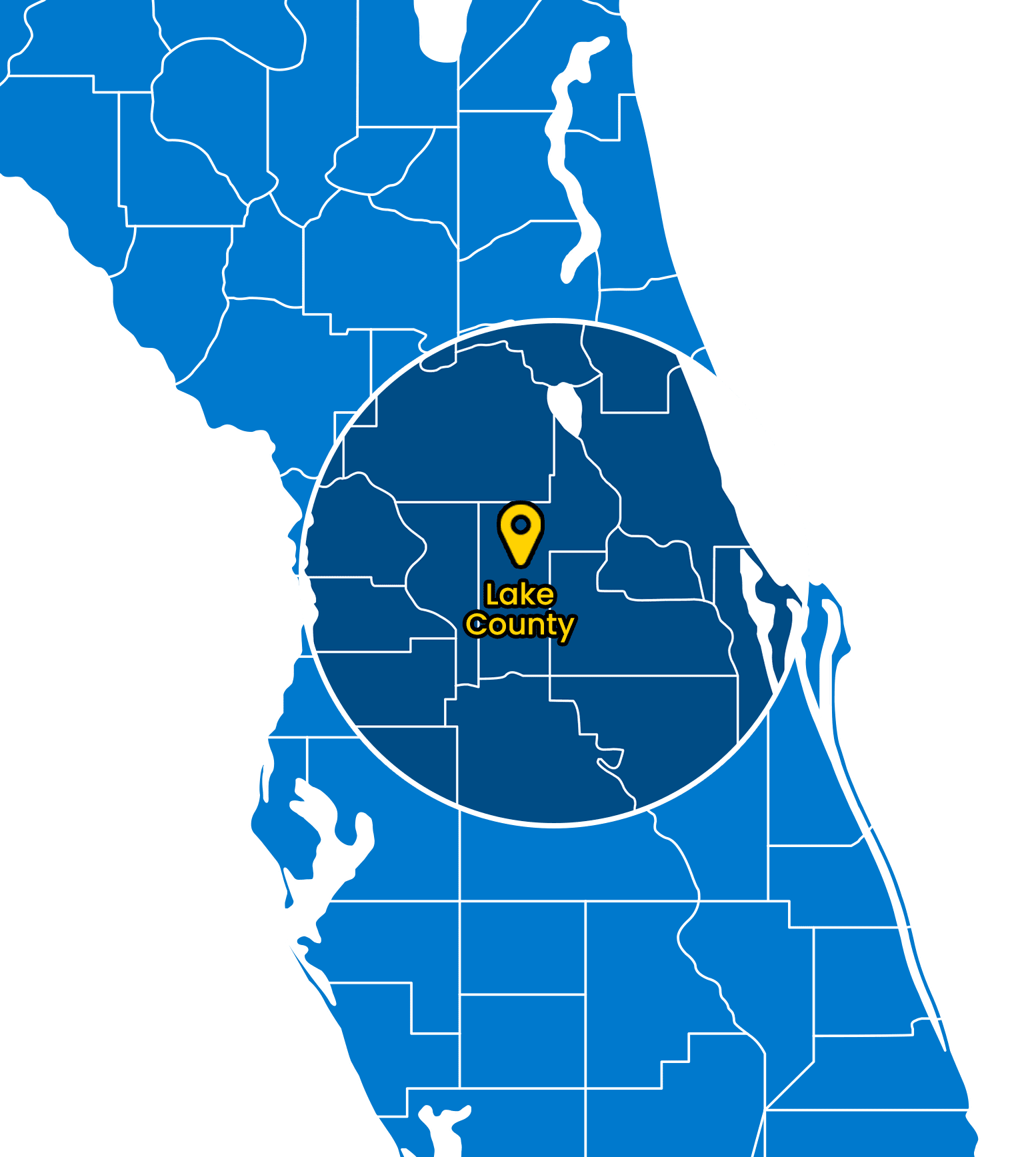

If you're dealing with water damage right now and need help navigating both the restoration process and insurance claims, contact us for a free consultation. We're available 24/7 because water damage doesn't wait for business hours, and neither do we.

Need immediate help with water damage? Florida Fire & Flood provides 24/7 emergency response throughout Central Florida. Our IICRC certified team has years of experience working with insurance companies to ensure your claim is handled properly from day one.

Randy Lazarus

About The Author:

Randy Lazarus is the owner of Florida Fire & Flood, a locally owned and family-operated restoration company serving Central Florida communities since 2021. Leading a team of IICRC-certified technicians, Randy has built a reputation for providing 24/7 emergency response and compassionate service to homeowners and businesses facing water damage, fire damage, and mold emergencies. As a member of the Central Florida community, Randy understands the unique challenges property owners face in the region and is dedicated to helping his neighbors restore their properties and get back to normal life.