AMRT - Applied Microbial Technician I, (Mold Remediation)

Jump to Section:

Nobody wakes up thinking, "I hope my pipes burst today so I can practice my photography skills!" But here we are, and if you're reading this, chances are you're dealing with water damage in your Mount Dora home. The good news? We've helped hundreds of families navigate this exact situation, and proper documentation can make the difference between a smooth insurance claim and months of headaches.

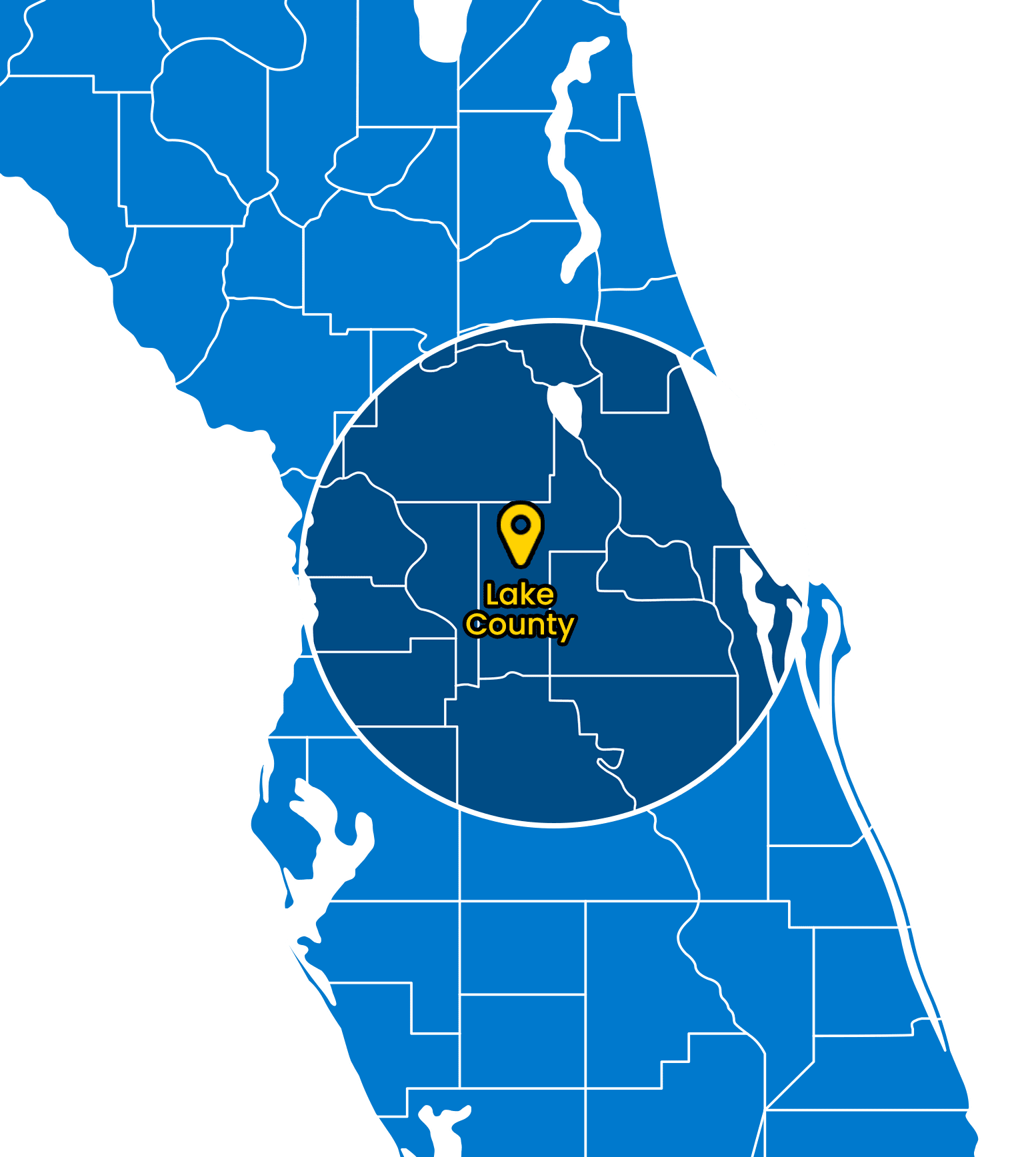

At Florida Fire & Flood, we've seen it all. Whether you're dealing with water damage restoration needs or just trying to understand the documentation process, we've helped hundreds of families navigate this exact situation. From burst pipes during those rare cold snaps to storm damage from Florida's unpredictable weather. One thing we've learned over our years serving Central Florida is that the families who document everything from day one always have an easier time with their insurance claims.

Let's walk through exactly what you need to do to protect yourself and get the coverage you deserve.

Why Proper Documentation Matters for Water Damage Claims

Think of documentation as your insurance claim's best friend. Insurance companies need proof, and lots of it. They want to see what happened, when it happened, and how extensive the damage is. Without proper documentation, you're essentially asking them to take your word for it, and that rarely ends well.

We've worked with most major insurance companies in Central Florida, and trust us when we say they appreciate thorough documentation. It speeds up the entire process and helps ensure you get the full coverage you're entitled to under your policy.

Understanding your Florida water damage insurance policy is crucial for proper claim documentation and coverage.

What to Document Immediately After Water Damage

Time is everything when water damage strikes. Here's your immediate action plan:

Take Photos and Videos Right Away

Before you touch anything, grab your phone and start documenting. We know it feels overwhelming, but these first photos are crucial. Capture:

- The source of the water damage (burst pipe, leaky roof, etc.)

- Standing water in all affected areas

- Wet floors, walls, and ceilings

- Damaged furniture and belongings

- Any visible mold or discoloration

Pro tip: Take both wide shots showing the entire room and close-up shots of specific damage. Your insurance adjuster will thank you later.

Document the Timeline

Write down exactly when you discovered the damage. If you know when the incident occurred (like when a pipe burst), note that too. Insurance companies care a lot about timing, especially if there's any question about whether the damage happened gradually or all at once.

Water Damage Documentation Timeline

Essential Documentation Checklist for Mount Dora Homeowners

Here's your comprehensive checklist for documenting water damage:

| Documentation Type | What to Include | Timing |

|---|---|---|

| Immediate Photos | Water source, standing water, affected rooms, damaged items | Within first hour |

| Timeline Documentation | When damage occurred, when discovered, weather conditions | Same day |

| Progress Photos | Daily changes, drying progress, new damage discovered | Daily until complete |

| Professional Reports | Moisture readings, assessment reports, estimates | Within 48 hours |

| Communication Records | Insurance calls, contractor contacts, receipts | Ongoing |

Need Professional Help With Documentation?

Our IICRC-certified team handles all documentation and works directly with insurance companies to ensure your claim is properly supported from day one.

Get Free ConsultationHow to Photograph Water Damage Like a Pro

You don't need to be a professional photographer, but a few simple techniques will make your documentation much more effective:

Lighting and Angles Matter

- Use natural light when possible, or turn on all available lights

- Take photos from multiple angles of each damaged area

- Include reference points like doorways or furniture for scale

- Don't use flash if it creates glare on wet surfaces

What Insurance Adjusters Want to See

Insurance adjusters look for specific things in damage photos. They want to see:

- The source of the water intrusion

- How far the water spread

- Which materials are affected (drywall, flooring, insulation)

- The height of water lines on walls

- Any structural damage

Remember, it's better to take too many photos than too few. You can always delete duplicates, but you can't go back in time to capture damage that's already been cleaned up.

Working with Restoration Professionals on Documentation

Here's where having experienced professionals makes a huge difference. When you work with a certified restoration company like ours, we handle much of the documentation process for you. Our IICRC-certified technicians know exactly what insurance companies need to see.

We use professional-grade moisture meters and thermal imaging cameras to document damage that might not be visible to the naked eye. This is especially important in Florida's humid climate, where moisture can hide in walls and under flooring.

Professional moisture detection equipment reveals hidden water damage that standard cameras cannot capture, providing crucial documentation for insurance claims.

Our team photographs and documents everything throughout the restoration process. We've found that having this professional documentation can significantly speed up claim approvals. Our water damage restoration process includes working directly with insurance companies to ensure proper documentation.

Common Documentation Mistakes to Avoid

We've seen these mistakes cost homeowners thousands of dollars in denied or reduced claims:

Starting Cleanup Before Documentation

We get it, you want to start cleaning up immediately. But moving damaged items or starting the drying process before taking photos can hurt your claim. Document everything first, then begin cleanup.

Not Documenting Personal Property

That soaked photo album might not seem important to photograph (since it's already ruined), but insurance companies need to see all damaged personal property. Create an inventory with photos of everything affected.

Forgetting About Hidden Damage

Water loves to hide. It gets into walls, under flooring, and in places you can't see. Professional restoration companies use specialized equipment to find and document this hidden damage. Don't assume what you can see is all there is.

Understanding Florida's Insurance Requirements

Florida has specific requirements for water damage claims that Mount Dora residents need to understand. The state requires prompt notification of losses, and some policies have strict deadlines for filing claims.

Our experience working with Florida insurance companies has taught us that thorough documentation from the beginning almost always leads to better outcomes. We've seen claims denied simply because homeowners didn't properly document the extent of damage or waited too long to file.

If you're unsure about your policy's requirements, this guide on homeowner insurance coverage for water damage in Florida can help clarify what's typically covered.

When to Call Your Insurance Company

Don't wait to contact your insurance company. Most policies require "prompt" notification, which typically means within a few days of discovering damage. When you call:

- Have your policy number ready

- Provide a clear, factual description of what happened

- Mention any immediate steps you've taken to prevent further damage

- Ask about preferred restoration contractors (though you're not required to use them)

For more detailed guidance on timing, check out our article on when to call insurance after home flooding.

The Role of Professional Water Damage Assessment

Professional assessment goes beyond what you can document with your phone. Certified restoration professionals use:

- Thermal imaging cameras to detect moisture behind walls

- Professional moisture meters for accurate readings

- Air quality testing to check for mold development

- Structural assessments to determine if framing or foundations are affected

This professional documentation often uncovers damage that would otherwise go unnoticed until it becomes a bigger, more expensive problem. Our team provides detailed reports that insurance companies trust, which can significantly impact your claim outcome. In cases where water damage leads to secondary issues, our mold remediation services also include comprehensive documentation for insurance purposes.

For Mount Dora residents, our local water damage restoration services include comprehensive documentation and direct insurance company coordination.

Protecting Your Rights During the Claims Process

Knowledge is power when dealing with insurance claims. Here are your rights as a policyholder:

- You have the right to choose your own restoration contractor

- You can request a second opinion if you disagree with an adjuster's assessment

- You're entitled to temporary housing coverage if your home is uninhabitable

- You can dispute claim denials through Florida's Department of Financial Services

Remember, insurance companies are businesses. They want to settle claims fairly, but they also want to minimize payouts. Having thorough documentation and working with experienced professionals levels the playing field.

Preventing Future Water Damage Documentation Headaches

While we hope you never need this advice again, here are some proactive steps every Mount Dora homeowner should take:

- Take annual photos of your home's interior and exterior

- Keep receipts for major purchases and home improvements

- Know where your water main shutoff valve is located

- Consider installing water detection devices in vulnerable areas

- Review your insurance policy annually to understand coverage limits

For more preventive tips, our guide on minimizing water damage offers practical advice for Florida homeowners.

Frequently Asked Questions

What specific photos should I take first when documenting water damage in my Mount Dora home?

Start with the water source (burst pipe, roof leak, etc.), then photograph the extent of standing water from multiple angles. Take wide shots of each affected room, then close-ups of damaged materials like soaked drywall, flooring, and furniture. Include reference points for scale, such as measuring tape or common objects. Don't forget to photograph water lines on walls and any discoloration or staining.

How do I document water damage that I can't see, like moisture behind walls?

Professional restoration companies use thermal imaging cameras and moisture meters to detect hidden moisture that regular cameras can't capture. These tools create visual documentation of moisture levels within walls, under flooring, and in other concealed areas. This professional documentation is crucial because hidden moisture often causes the most expensive long-term damage and mold growth.

Should I create a written inventory along with photos when documenting water-damaged belongings?

Yes, create a detailed written inventory that includes item descriptions, approximate age, purchase price (if known), and current condition. Pair each inventory item with photos showing the damage. Include model numbers and serial numbers for electronics and appliances. This combination of written and visual documentation gives insurance adjusters the complete picture they need for accurate claim processing.

What's the best way to organize my water damage documentation for the insurance company?

Organize your documentation chronologically and by room or area. Create folders with clear labels: "Initial Discovery Photos," "Day 1-3 Documentation," "Professional Assessment Reports," and "Ongoing Progress Photos." Include a timeline document that correlates photos with dates and times. Most insurance adjusters prefer digital files organized in a logical sequence that tells the complete story of the damage and restoration process.

Ready to Get Professional Documentation Help?

Dealing with water damage is stressful enough without worrying about whether you're documenting everything correctly. Our team at Florida Fire & Flood has helped hundreds of Central Florida families navigate insurance claims successfully. We handle the documentation, work directly with your insurance company, and restore your home to pre-damage condition.

Available 24/7 for Emergency Service

We're locally owned, IICRC certified, and we understand exactly what Mount Dora families need during these challenging times.